VIAlab is a new generation of company that uses generative AI to produce the revolutionary and patent-pending VIA3 score.

Traditionally, “sustainability” data has been subjective, self-reported, and stochastic. It was noise.

VIAlab has changed the equation. We have normalized sustainability, transforming it from a moral concept into a standardized form of investment risk and a quantifiable opportunity to innovate.

Just as a credit score distills a lifetime of financial behavior into a single number, the VIA3 Score distills millions of extra-financial data points into one objective truth allowing

at-a-glance decision making.

Meet Janet:

The Intelligence Behind VIAlab

Janet is not a standard chatbot.

She is a deterministic AI analyst capable of reasoning across the entire universe of securities in our system.

She reads what human analysts cannot—ingesting millions of pages of regulatory filings, court documents, and financial reports to build the 980+ data points that power the Compass and the entire VIAlab Investor and Research Platform.

The VIA3 AI Score™ brings clarity.

It is your directional gauge for financial durability.

The existing landscape suffers from a “Measurement Gap.” Current ESG scores act like a student’s report card—subjective, grade-based (AAA to CCC), and focused on behavior.

VIAlab has created a Financial Resilience Score—objective and math-based; quantifying sustainability as risk.

Ignore it at your own peril.

Built on the foundation of the VIA3 score, the VIAlab Investor and Research Platform ties everything together: enabling you to create compasses with Janet to select securities based on risk for portfolio construction; using Janet to create research notebooks of securities as candidates that can be promoted to a portfolio.

With your portfolios, you can run forecast simulations, as well as benchmark them against the market, other portfolios, and even your research notebooks.

The VIAlab Investor and Research Platform revolutionizes institutional investing creating a single platform for research, portfolio construction, and stewardship.

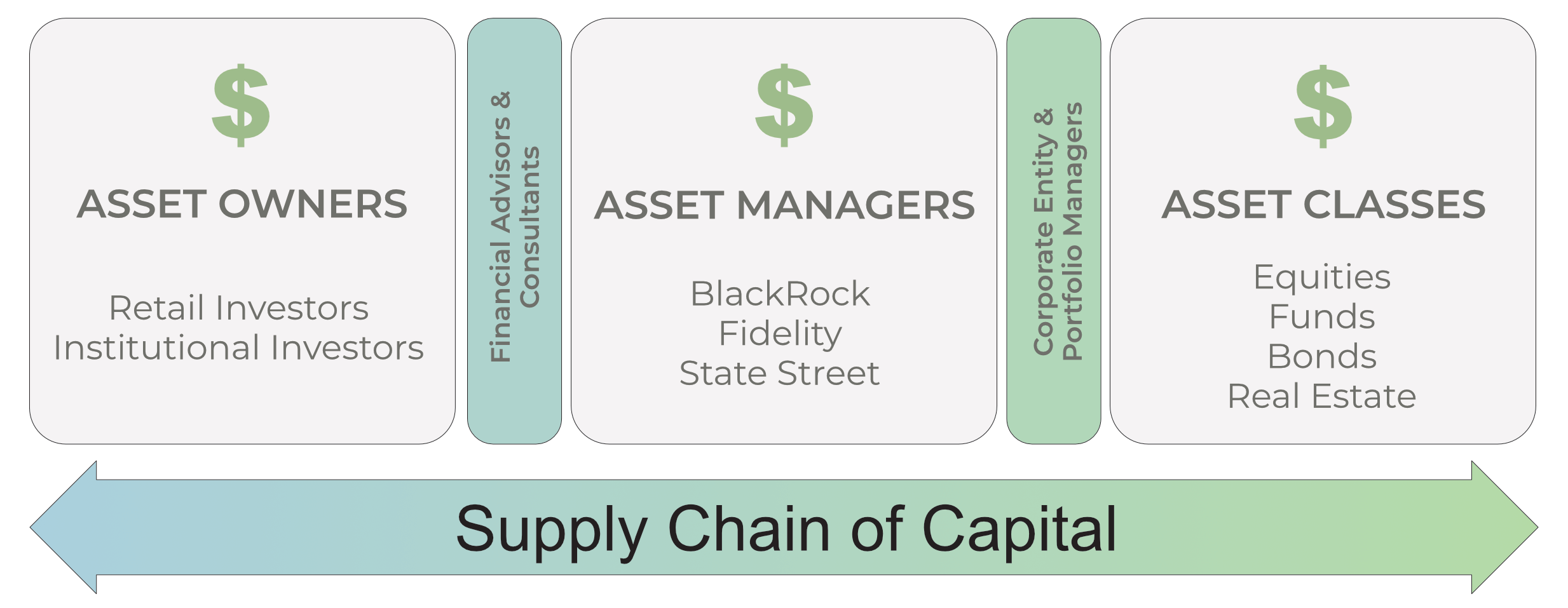

Securing the supply chain of capital

The Vision: Our mission is to integrate VIA3 across the entire supply chain of capital to ensure transparency from origin to destination.

Early Traction

2026 Finalist: Best ESG & Sustainability Analytics Platform

Accelerated to the $100K Scale TIer

Five Institutional Beta Partners

We are launching with a private beta…

Why Choose Us

Our Mission is to create change by showing that you can make money while investing sustainably

What are you waiting for?

Ready to take the next step? Let’s bring your transparancy and sustainability to your investments while making money! Explore how you can be the hero and part of the solution. Together, we’ll make it happen.

Our team

VIAlab merges profound expertise in sustainability and finance with decades of AI and technology leadership.

The VIA3 score was first conceived by Chad Spitler, a former BlackRock executive and founder of the respected ESG consultancy Third Economy in 2019. While his VIA3 system showed clear promise and accuracy in beta tests, the initial manual approach—costing $10,000 and months of analyst work per security—faced commercial headwinds and was only able to be used in product development.

Then, on November 30, 2022 and the launch of ChatGPT, Generative AI emerged as a transformative catalyst. Bryan Hughes, a 39-year technology leader, GenAI specialist, and trusted advisor to Chad for ten years, envisioned its potential. He saw that GenAI could finally make the robust VIA3 methodology scalable and highly cost-effective (pennies per score). This realization was the impetus for VIAlab cofounded by Bryan and Chad, strategically spun off to leverage this technological leap and deliver VIA3’s groundbreaking insights to the entire market.

Bryan Hughes

Co-Founder

35+ years in technology, 2 decades in startups, founded 3 companies as CEO and CTO, sold one to Nokia. Expert in generative AI. Founding member of the NVidia Jetson AI Lab Research Group.

Chad Spitler

Co-founder

25+ years in finance, built BlackRock’s sustainability and stewardship teams and advised the largest investors in the world on sustainability. Named 100 most influential people in governance by NACD. Dean’s Advisory Board University of Michigan SEAS.

Balazs Ree

co-founder

25+ years in enterprise web development, expert in robust application development, and long-term collaborator with Bryan.

Abbe Billings

Senior Advisor

16+ years in corporate governance & sustainability (ex-BlackRock), 30 years in sales enablement and client engagement.

Dr. Todd Cort

Yale School of Management

principal Advisor

Yale School of Management Metrics and standards for measuring the environmental impacts of fixed income investment products such as green bonds; underlying data for environmental, social and governance (ESG) that demonstrably drive corporate growth and improvement in equity value; and underwriting more sustainable insurance products – particularly around the means to measure effective climate adaptation

Dr. Joe Árvai

Director, Wrigley Institute, USC.

principal Advisor

Senior Researcher at the Decision Science Research Institute in Eugene, OR, and an Adjunct Professor in Engineering and Public Policy at Carnegie Mellon University in Pittsburgh, PA. Also science advisor to the administrator of the United States Environmental Protection Agency; and member of the National Academies of Sciences’ Board on Atmospheric Science and Climate.

Jen O’Neil

principal Advisor

Founder, CEO, and investor with more than two decades of experience building and scaling category-defining marketplace companies. Jen co-founded Tripping.com, a vacation rental metasearch platform. As Chairman and CEO for nearly 10 years, she raised $60M+ in venture capital, scaled globally, and navigated complex growth, partnership, and board dynamics. That journey gave her deep experience in corporate governance, international expansion, capital markets, stakeholder alignment, and building great teams.

Explore Our Blog

ESG Is Dead, Long Live ESG

This has become a very common cry with many[…]