VIAlab’s AI analyzes

actual company behavior

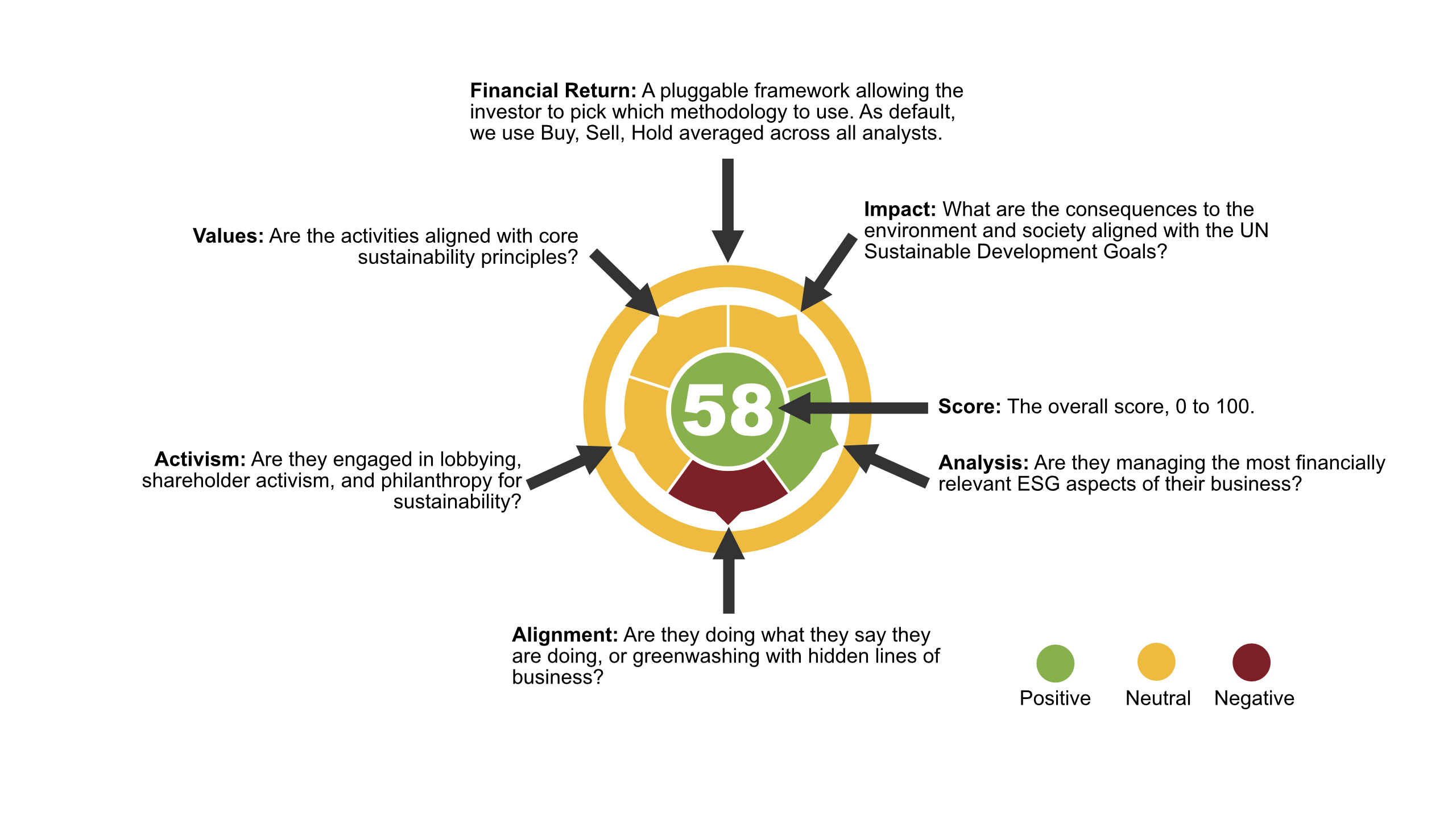

We don’t score companies on their ‘goodness.’ We score them on their stability. Our AI evaluates every security across six pillars, including Alignment and Activism, to detect ‘greenwashing’ (fraud risk) and ‘activist targets’ (governance risk). This is a deterministic, unchangeable rubric. If a company is hiding a line of business or lobbying against its stated goals, our score exposes the duplicity before the market prices it in.

The market is filled with hidden liabilities—litigation, regulatory crackdowns, and resource scarcity. Traditional analysis ignores them. ‘ESG’ politicizes them. VIAlab quantifies them. We ingest millions of documents to generate 980 distinct risk signals for every security, giving you a forensic structural integrity score that protects you from the risks others don’t see until it’s too late.

Our VIA3TM score shows you this risk at-a-glance as a compass calibrated to a color coded alignment

from negative (red), to neutral (yellow), to positive (green).

The greener the better.

Unlock Financial Opportunities

The VIA3 AI Score™

The VIA3 AI Score is the foundation of the VIAlab platform. It is the ‘FICO’ score for structural integrity, providing a single, deterministic metric to stress-test the safety of any security across global markets.

Our forensic AI ingests a vast universe of data—ignoring corporate self-reporting to find verifiable evidence—to produce a transparent liability rating. This allows fiduciaries to instantly distinguish between solid assets and those carrying hidden, material risks.

Forensic Risk Solutions

Instantly stress-test any security with our proprietary AI-driven VIA3 score. We distill millions of forensic data points into a single, deterministic metric, giving you a clear and immediate signal on material risk amidst the market noise.

The score provides a rigorous, multi-pillar audit focused on financial performance while simultaneously offering unprecedented visibility into a security’s structural vulnerabilities.

This enables fiduciaries to make data-backed decisions that drive stronger financial returns and eliminate exposure to avoidable operational failures.

Understanding Sustainability as Risk

A stock can post record profits while sitting on a foundation of liability. Traditional analysis stops at the balance sheet; VIAlab digs into the legal and operational bedrock to expose “toxic” assets that threaten future value.

The Governance Risk: The “Texas Two-Step” We frame bad governance not as a moral failing, but as a material risk. For example, our forensic AI detects if a corporation has re-domesticated to Texas to exploit the “Texas Two-Step” bankruptcy law. This controversial legal maneuver allows a company to split into two entities, shift its toxic liabilities (such as mass tort claims) into a new subsidiary, and then immediately bankrupt that subsidiary to shield the parent company’s assets.

While this may temporarily protect the stock price, our model identifies it as a critical Governance Risk. It signals that management is engaged in financial engineering to survive a catastrophe, rather than operating a sustainable business. We quantify this risk so you aren’t left holding the bag when the legal shield fails.